Gold

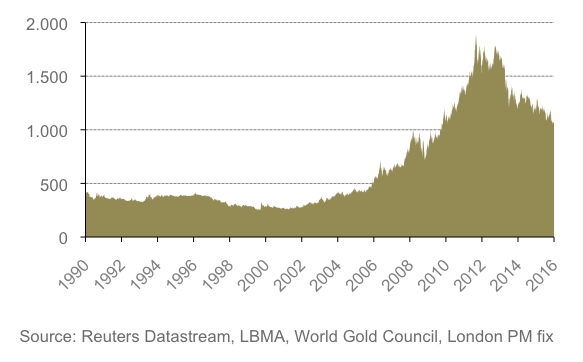

price is on fire. It looks like something big has happened in the gold market.

There was a magnificent change of trend in the gold prices from the mainstream

during the first quarter of 2016. This shows that the investors are having

insecurity about stock market and they are finding a way towards safe

investment somewhere else… gold market may be…

Over

the past several years gold market the gold market has been agonized by the

decline in the outflow of gold from Gold ETF’s and Funds. This decline in the

new outflows brought a drastic change in the international gold market in first

quarter of the year.

According

to Gold Demand Trends of World Gold Council the entire gold market suffered the

net outflows from Gold ETF’s and such similar funds except for the small

outflow of 25 metric ton that was built during first quarter of 2015. In the

first quarter of 2016, this out flow was built up to 363 metric tons which is

actually recorded to be the second highest build in the history of Gold ETF’s

and Funds.

The

first highest metal inventory was built at Global Gold ETF’s and Fund in first

quarter of 2009. This was the time when stock markets were crashing down at

their lowest levels. AT that time, the Global Gold ETF’s and Fund inventories

rushed at 465 metric ton which was the highest ever.

There

three important factors that act as driving force for bringing major change in

gold markets are:

- Net Sales and Purchases by Central Bank

- Demand of gold coins and bars

- Gold ETF’s and Fund Flows

When

the Central Banks in West dumped 663 metric tons of gold in the market by the

year 2005, the result was decline in the demand of total gold investment that

reached 58 metric ton. This can be compared to the situation of gold investment

demand of the year 2012 when it reached 2174 metric ton. This was an outrageous

swing in the investment demand of gold with the difference of 2232 metric tons

from 2005 to 2012. This catalyzed the prices of gold to hit as high as $ 1669

in Q1 of 2016.

In

current situation, the investors need to realize that the popping up of wide Bonds

and Stocks markets by Fed and other central banks won’t last forever. There

might even be the possibility that Gold ETF’s and Fund Flows won’t even be

having the gold that has been declared on records. The evidence of this is massive

investments in paper gold. The investor only invests in the certificate and never

gets to have gold in physical form. Most of the demand of gold investment is

fulfilled this way. What investors really need to know is that if the flow of

the mainstream investors would sign of things to come in future the things are

really going to take new twists and turns by the year 2017.

Impressive

ReplyDeleteUsing BullionVault you can acquire physical gold & silver by the gram at current market exchange rates.

ReplyDeleteYour gold and silver is stored at one of 5 secured international vaults. And you may exchange it online or take away physical bars.