The Euro As Reserve Currency

The

currency used by the official sector for the use as an international currency

to perform operations is referred as reserve currency.There

are three main components of foreign currency which are medium of exchange,

store of value and unit of account.

Monetary

authorities usually use this currency as exchange rate tool to obtain monetary objectives,

to intervene in foreign markets and to safe keep wealth. The private sector has

a separate use of foreign currency and mostly use for invoicing. The choice of

international currency is not decided by Government. The private sector

determines the choice of international currency to be used.

The

reserve currency is dependent upon four factors:

1. Share

of the country in the international trade.

2. Macroeconomic

stability

3. Market

development in term of liquidity and breadth.

4. Network

externalities of how other countries are using any currency as reserve

currency.

Status of Euro:

During

post-war era Dollar was dominant because it macroeconomic stability, network

externalities and financial development. In 1990 EMU started debate on the

potential of the euro against dollar. Some researchers argued that the

attractiveness I dollar is due to its liquidity in T-bills as compared to euro.

It is believed that the major limitation on euro is to play international role

is due to the obstacle in full integration of euro government bond market.

One

view point is that having two currencies at a tie as international currencies

would make system inefficient. Studies show that euro is more sound currency as

medium of exchange than the store of value. Researchers also argued that after

monetary union euro’s role would match dollar in international markets.

International investors should invest in euro to diversify and hedge their

macroeconomic risks.

Composition Of International

Reserves:

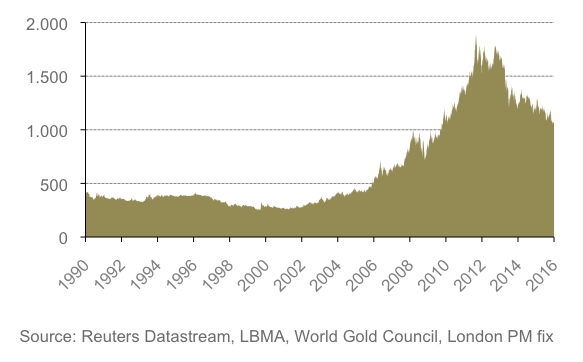

Official

reserve assets are being well diversified nowadays. The share of euro is

increased after monetary union however still it is lower than dollar. In 1990

the nadir of US was 455 of reserves and deposits. By 2007 it increased to 70%.

However, it declined to 59% by 2006.

The

main reason of decline was adoption of euro and diversification of reserve

currency. Studies show that the reserve managers in Asia respond asymmetrical

to valuation effect. These managers respond to interest rate more than exchange

rates fluctuations.

The

reserve allocation of euro has increased significantly from 19% to 27 % from

1999 to 2003. However, the financial allocation is more in euro region than in

Asia or America. Since 1970 the reserve managers tend to attract more towards

instrument perceived portfolios due to risk-adjusted returns. Now reserve

managers invest in longer –dated debt securities than deposits.

Role

as a Medium of Exchange

Traditionally,

reserve management has been guided by two basic reasons. One is to prepare for

contingencies and the other is an emergent need to intervene in financial

market. This requires for holding reserves in the most liquid form, which is

referred to as ‘liquidity tranche’. It occurs due to the potential need to turn

assets into cash on short notice and at low cost under different market

conditions. This role of medium of exchange may arise in the foreign exchange

market or in government securities market.

Foreign

Exchange Markets

The

choice of the currency for intervention in the FE market is mostly dependent

upon the liquidity conditions in foreign exchange markets. Because when there

is need to influence a bilateral exchange rate, it is sometimes more effective

to do so in a third, more heavily traded currency. While the euro seems to be

as liquid as its predecessor currencies, it is unclear whether the euro has

become more or less liquid compared with the US dollar (Galati and Tsatsaronis,

2003). The results of the 2007 BIS Triennial Survey of Foreign Exchange and

Derivatives Markets reveal that the euro entered on one side of 37% of all

foreign exchange transactions in April 2007. The dollar’s share in foreign

exchange markets was little changed between 1998 and 2007 at about 86%.

Dollar/euro was by far the most traded currency pair in 2007, capturing 27% of

global turnover.

Money and Government Securities Markets

The

choice of intervention currency is influenced by liquidity conditions in asset

markets. Reserve managers typically invest the bulk of their reserves in

instruments with limited market and credit risk.

EMU

increased the attractiveness of diversifying reserves from dollars into euros

by creating the second largest government securities market in the world.

However, there are certain advatages that Dollar has over Euro, which are

discussed as under:

- US

Treasury market that makes it a relatively more attractive destination for

reserves is the large bill

market. The short-term segment of the US Treasury market is much

larger than its euro equivalent, mainly owing to the limited issuance of

treasury bills in the euro area.

- The

other advantage is in terms of homogeneity

and high credit quality of the US Treasury market. There is one

issuer, rated AAA. On the other hand, 12 different issuers participate in

the euro government securities market. Furthermore, several euro area

governments are rated below AAA, and so the average rating of outstanding

euro government securities is AA1.

- The

most important advantage the US Treasury market has over its euro or yen

equivalents is its tremendous

liquidity. The daily turnover of US Treasuries greatly exceeds

that of any other instrument. While turnover is not synonymous with market

liquidity, it can be indicative of the depth of the market, i.e. the size

of the order flow that the market can accommodate without moving prices

(CGFS, 2000)

Hence

we can safely assume that the US dollar retains several advantages over the

euro as a medium of exchange. The US dollar is more widely traded in foreign

exchange markets, and dollar government securities and repo markets are more

liquid than their euro counterparts. This supports the continued pre-eminence

of the US dollar as a reserve currency. Therefore, for intervention purposes the euro is an

increasingly attractive alternative to holding dollars.

Role As Unit Of

Account

Broadly

the Unit of account characteristic of reserve currency fall in two broad

categories:

- In

private use this role is linked to the currency of choice for invoicing.

- In

official use it is linked to the choice of an exchange rate as a monetary

anchor.

This

role heavily depends on the direction of trade among the countries and relative

stability of the macroeconomic policies of the host country which owns the

currency. In summary, evidence from exchange rate co-movements suggests that

the euro plays an increasingly important gravitational role. Ceteris paribus, this

would tend to boost the euro’s share of global reserves over time. The US

dollar, however, is still the most important currency along this dimension.

Since 2002, the US dollar has depreciated against many currencies, and so the

higher co-movement of currencies with the euro may reflect temporary dollar

weakness rather than a long-term increase in the euro’s influence.

ROLE

AS A STORE OF VALUE

For

this role of a reserve currency it is important for the reserve managers to

choose a currency which has a rather reliable future in terms of its future

purchasing power. Hence, this aspect mostly relies upon the future prospects of

a country. The store of value aspect of reserve currency is directly related to

the investment policies of the governing authority as well as the level of

development of financial instruments available for investments in that currency

for gaining exposure to, or hedging, these risks.

CONCLUSIONS

The

main theme of this paper was to investigate how the euro’s role in

international financial markets has influenced the use of euro-denominated

assets as official reserves. The introduction of the euro in 1999 as a single

currency for multiple countries, which were highly developed and extensively

involved in trade, resulted in extensive debate in academia as well as

professional circles regarding future role of Euro and fate of Dollar. With extensive development of euro financial

markets, there is a view that Dollar might lose its position as a dominant

reserve currency at global level. Nevertheless, in terms of size, credit

quality and liquidity, dollar financial markets still have an edge over euro

markets. This is the main reason why Euro is currently not in a position to

compete with Dollar in the international market.

Author: Zarmeen Mushtaq , Sofia Khurrum